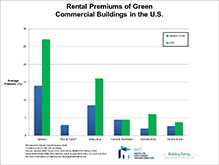

Dozens of statistical studies have proven that commercial tenants, investors, and consumers are willing to pay a premium to lease or buy energy-efficient properties. Even controlling for other factors (like location and size), research shows that green, efficient commercial buildings are more valuable assets than their peers. This chart outlines rental premiums of green commercial buildings the U.S.

References:

Green Certification and Building Performance: Implications for Tangibles and Intangibles | A. Devine & N. Kok, The Journal of Portfolio Management | 2015

Green Design and the Market for Commercial Office Space | J. Wiley & J. Benefield, College of Charleston and K. Johnson, Florida International University | 2010

Green Noise or Green Value? F. Fuerst & P. McAllister, University of Reading | 2011

How Risky are Sustainable Real Estate Projects? | J. Jackson, Texas A&M University | 2009

Investment Returns from Responsible Property Investments | G. Pivo, University of Arizona and J. Fisher, Indiana University | 2010

Doing Well by Doing Good? Green Office Buildings | P. Eicholtz & N. Kok, Maastricht University and J. Quigley, University of California, Berkeley | 2010

Related Resources:

Chart: Added Value of ENERGY STAR-labeled Commercial Buildings in the U.S. Market

Chart: Occupancy Premiums of Green Commercial Buildings in the U.S.

Chart: Sale Premiums of Green Commercial Buildings in the U.S.