To better understand how real estate managers view energy efficiency and to learn how energy management is being integrated into commercial real estate activities, the Institute of Real Estate Management (IREM) and IMT recently collaborated to produce Building Performance That Pays: Insights From the First IREM® Energy Efficiency Survey (download the full report for free on IREM’s website).This inaugural survey was distributed to both IREM and Building Owners and Managers Association (BOMA) members who ranged from property and asset managers to brokers and finance personnel, (see table 1).

As the report’s title suggests, it covers issues around energy efficiency and finance, including impacts to building owners’ bottom line and barriers to greater investment in energy efficiency. Before I get into the meat of the report, I’d like to examine one of the initial survey questions that yielded a promising response.

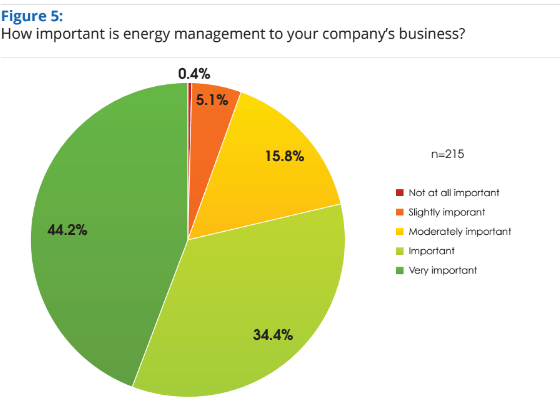

80 Percent of Respondents Say Energy Management Is “Important” or “Very important”

As shown in the below graph, approximately 80 percent of survey participants stated that energy management was either “very important” or “important” to their company’s business. This is welcome news for not only companies that sell energy management products and services, but also cities and states looking to engage with real estate managers and other key players in the private market on energy and water efficiency solutions that reduce pollution and put money back into local economies.

One caveat to keep in mind, however, is that it’s possible those who responded to IREM’s survey are more interested in energy efficiency than the typical real estate manager—a research challenge known as selection bias. How would other real estate managers have responded to this question? To answer that will require continued research and market engagement.

Better Energy Management: Motivations and Challenges

When asked what motivates their company’s approach to energy management, survey participants primarily indicated the financial benefits as one would expect. The number one response, “Energy management controls expenses,” highlights an obvious financial benefit of energy efficiency—reduced operating expenses and specifically utility costs. However, the second most popular response, “Energy management drives higher tenant demand and retention,” alludes to a subtler financial benefit—that owner income may rise due to rental premiums and less vacancies, as tenants may be willing to pay more to live or work in a high-performing and environmentally friendly space. In fact, IMT has compiled the results of studies revealing that green building certifications can result in rental, occupancy, and sales price premiums.

One example of a recent study comes from Bentall Kennedy, which manages 34 million square feet of U.S. office properties. The company found that rental rates were 3.7 percent and 2.7 percent higher for LEED and ENERGY STAR-certified buildings, respectively. Occupancy rates were also higher for green-certified buildings—4 percent higher for LEED-certified buildings and 9.5 percent higher for ENERGY STAR-certified buildings.

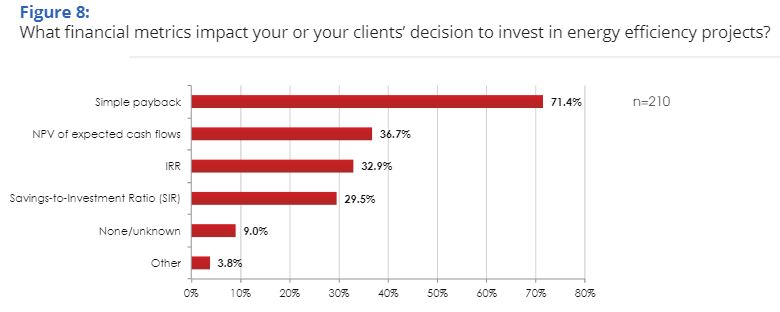

The report also describes a couple key barriers to greater investment in building energy efficiency. Real estate managers noted that simple payback is generally the preferred method used when assessing energy efficiency projects, but this basic form of financial analysis does not consider the energy and cost savings that accrue throughout an energy upgrade’s useful life.

For example, let’s say a facility manager is considering installing a new, energy-efficient boiler, which can take 5—10 years to recoup the initial investment. If the company has established a maximum acceptable investment payback period that is less than this timeframe, the project won’t be pursued even though boilers can operate and generate savings for over 20 years before needing to be replaced. Basically, this simple payback method can leave money on the table. Instead, IMT recommends the use of Net Present Value (NPV) analysis to fully account for the energy and cost savings that proposed energy efficiency measures will generate.

The second critical market barrier discussed in the report is the split-incentive between landlords and tenants. The split-incentive, which limits landlords’ interest in investing in building upgrades and tenants’ desire to adopt energy-efficient behavior, is a fundamental industry problem that affects buildings across the globe. IMT and other organizations are combatting this in the U.S. through initiatives like the Landlord-Tenant Energy Partnership and Green Lease Leaders. Supported by the U.S. Department of Energy (DOE), IMT’s Green Lease Leaders program recognizes landlords and tenants who have successfully added language to their leases to align incentives and galvanize investment in building energy efficiency. To date, Green Lease Leaders represent over 1 billion square feet of building space. The 2017 Green Lease Leaders application window will open in February for interested landlords and tenants.

Despite the promise shown by Green Lease Leaders and increased action across cities such as those participating in the City Energy Project, these market barriers will not disappear overnight. It will take a concerted effort to raise awareness of these issues among the relevant real estate decision makers and promote solutions such as NPV analysis and green leasing. IMT looks forward to engaging further with real estate professionals on these finance-related topics as we continue our push towards a high-performing built environment.